Closing costs are a standard part of completing a real estate transaction — they cover the fees and taxes both buyers and sellers may owe when ownership changes hands. For Toronto buyers, those costs commonly include legal fees, provincial and municipal land transfer taxes, title insurance and other transaction-related charges that can add up quickly. Below we explain when payments are typically due, which fees to expect, who usually pays what, how closing costs affect renovation budgets, and how legal counsel can help manage the process.

What Is the Typical Closing Costs Payment Schedule?

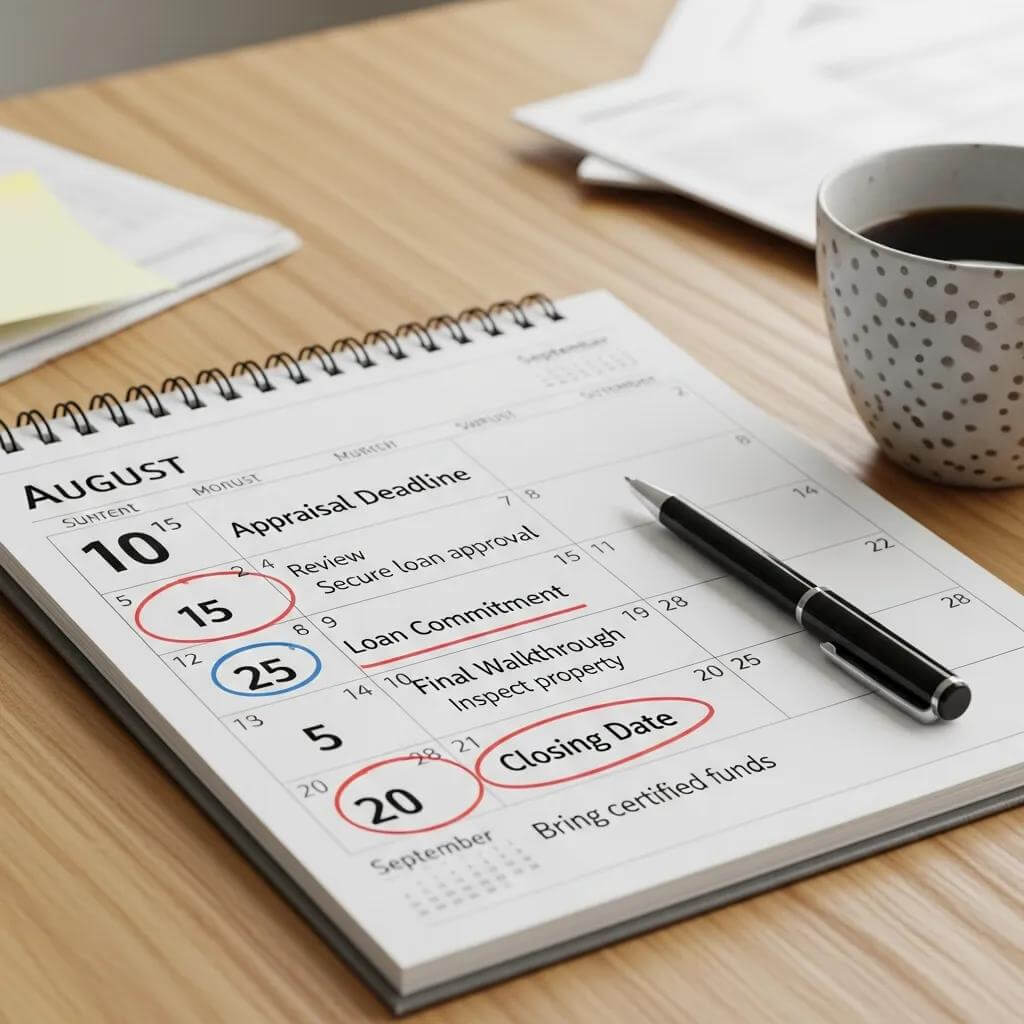

Closing costs are tied to milestones in the purchase process and are mostly concentrated around closing day. Some fees may be paid earlier (for example, inspection or deposit-related charges), but the bulk of costs are settled when the transaction completes. Knowing the timeline helps you arrange funds and avoid last-minute surprises.

When Exactly Are Closing Costs Due During Closing?

Most closing costs are collected on closing day, when title transfers from seller to buyer. Buyers provide funds to their lawyer or the closing agent to cover legal fees, land transfer taxes, title insurance premiums and any other agreed charges. Having funds in the form your lawyer requires prevents delays on the big day.

How Does the Closing Costs Timeline Affect Home Buyers?

The timing of closing payments matters for cashflow and planning. If funds aren’t ready when required, the transaction can be delayed, penalties may apply, or in extreme cases the deal could be at risk. Clear communication with your lawyer and lender about deadlines gives you the best chance of a smooth closing.

Which Fees Are Included in Home Purchase Closing Costs?

Closing costs cover several different charges; the exact mix depends on the property and the transaction. Below are the common items Ontario buyers should expect.

What Are the Common Real Estate Closing Expenses in Ontario?

In Ontario, common closing expenses include:

- Legal Fees: The fees charged by your lawyer for preparing and reviewing documents, handling funds and registering the transaction.

- Land Transfer Tax: A tax on the transfer of ownership — in Toronto this typically includes both the provincial land transfer tax and the municipal land transfer tax.

- Home Inspection Fees: The cost of a professional inspection to identify property issues (optional but strongly recommended).

- Title Insurance: Insurance that protects against certain title problems or defects that could arise after closing.

Because these costs accumulate, it’s important to build them into your overall purchase budget rather than treating them as an afterthought.

How Do Legal Fees Factor Into Closing Costs?

Legal fees are a key part of closing costs — they cover the lawyer’s work on title, mortgage documents, adjustments and registration. Fees vary with the complexity of the transaction and the lawyer’s rates, so ask for an estimate early and confirm which disbursements (searches, registrations, courier fees) will be added.

Who Is Responsible for Paying Closing Costs?

Who pays which closing costs can be negotiated, and some items are conventionally paid by one side or the other. It’s important for both buyers and sellers to understand and confirm these responsibilities in the purchase agreement so there are no surprises at closing.

Can Closing Costs Be Negotiated or Rolled Into the Mortgage?

Yes — some closing costs can be negotiated. Buyers may request that the seller cover certain expenses, or a lender may allow specific fees to be included in the mortgage under certain products. Not every cost can be financed, however, so check with your lender and get any agreements in writing.

What Happens If Closing Costs Are Not Paid on Time?

Missing payment deadlines can delay closing, trigger penalties or create a breach of contract. To avoid that, confirm the required amount and payment method with your lawyer well before the closing date and arrange funds in advance.

How Do Closing Costs Impact Renovation Project Budgets?

Closing costs reduce the cash available after purchase, which can affect how much you can allocate to renovations. Including closing costs in your pre-purchase budget gives you a clearer picture of what’s realistically available for improvements.

When Should Home Buyers Plan for Renovation Expenses?

Plan for renovation expenses as early as the offer stage. By factoring closing costs into your total purchase budget you’ll avoid overcommitting funds and can prioritize renovations based on what remains after closing.

How Can Legal Counsel Assist With Closing Costs and Renovation Planning?

A good lawyer helps by providing accurate estimates of closing costs, explaining which items will be due at closing, and ensuring the purchase agreement reflects any negotiated credits or conditions. That clarity makes it easier to plan renovations and move forward with confidence.